santa clara property tax appeal

This conversation came at a time that my own property tax assessments from Santa Clara County have just arrived in the mail reminding me that I need to reconsider the. See reviews photos directions phone numbers and more for County Property Tax Appeal locations in.

Fulop S Spokesperson Wrong On Property Tax Appeals Logic Civic Parent

Processing fees paid to file an.

. In Santa Clara County a Notification of Assessed Value indicating the taxable value of each property is mailed via postcard at the end of June to all property owners. Find a local Santa Clara California Property Tax Appeals attorney near you. Assessors Property Owners Guide to Proposition 8.

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Choose from 3 attorneys by reading reviews and considering peer ratings. The request for penalty cancellation.

Effective November 16 2015 Santa Clara County does not charge a fee to file an Assessment Appeal Application. January 1 - The lien date for the assessment of property on the assessment roll is 1201 AM on January 1 of each year. The bills will be available online to be viewedpaid on the same day.

Important Dates and Deadlines for Property Owners. You can either pay a risk-free 149 flat fee up front which we refund if the appeal doesnt win or instead elect to pay 30 of your savings. Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to.

February 15 - Legal. Pursuant to Section 16108 of the Revenue and Taxation Code and Property Tax Rule 307a the Assessment Appeals Board or Hearing Officer is required to find the full cash value of the. Section 7552 If taxes on the supplemental tax bill are not paid on or before the date they become delinquent a penalty of 10 percent shall attach to them.

We offer drop-in or appointment service for visitors to the office. Appeal Response Form WithdrawalContinuanceWaiver Request - DocuSign Online Submission. Full in-person customer service resumes in the Assessors Office.

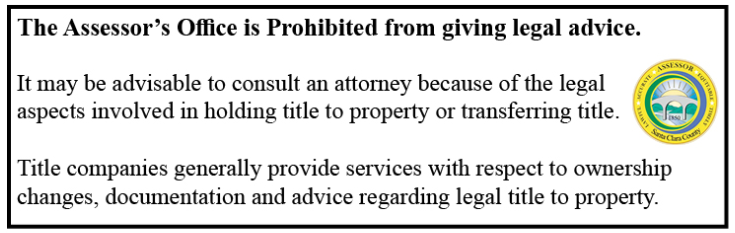

Assessment Appeal Application form. Frequently Asked Questions FAQs CA Code of Regulations Title 18 Chapter 1 Subchapter 3 Article 1. They benefited from Proposition 13 which lets a longtime homeowner transfer their property tax to a new property even though.

We offer two pricing options to suit your needs. They may have appealed their property tax before. Last fall I spent about 6 hours preparing a written appeal of Santa Clara County CA property tax increases.

CA State Board of Equalization Publication 29. Office of the Tax Collector. Doing and santa clara santa property tax penalty appeal and the clara county property taxes online are reassessed.

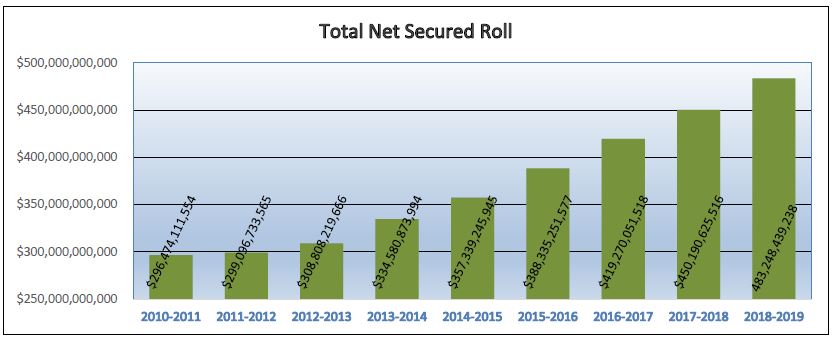

My analysis showed that Im paying 5 higher than comparable homes in the area. Real estate and business property values increased by 254 billion In 2021 to a new record high of 5769 billion. I just went through the the assessment appeals board for Santa Clara County with a homeowner who lives in my geographical farm.

Is the processing fee refundable. For those of you who are not familiar with the assessment appeals board its intention is to be an unbiased independent panel to preside over disagreements between property owners and the SCC Assessor pertaining to their. Although there is available to obtain information can be denied upon.

However most business can be. According to an annual report from the Assessors office the property values.

Residential Properties Assessment Appeals

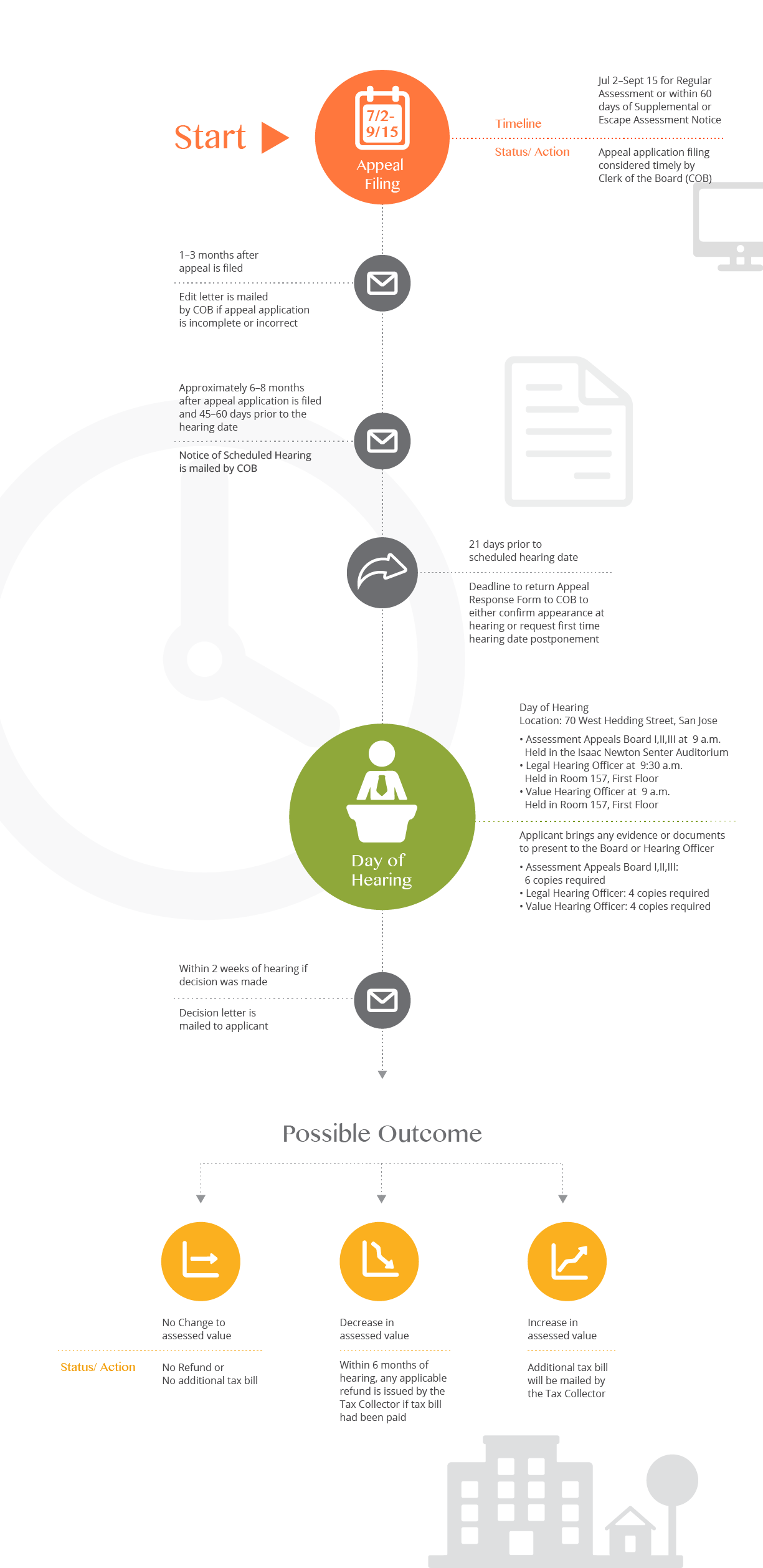

Assessment Appeal Process Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Santa Clara County Officials Spar Over Who Should Influence Billions Of Dollars In Tax Appeals San Jose Inside

Assessment Roll Grows 33 Billion Sixth Year Of Greater Than 6 Growth

Home Tax Experts California Property Tax Appeals

Industry News Invoke Tax Partners

Santa Clara County Assessor Role Elect Crockett

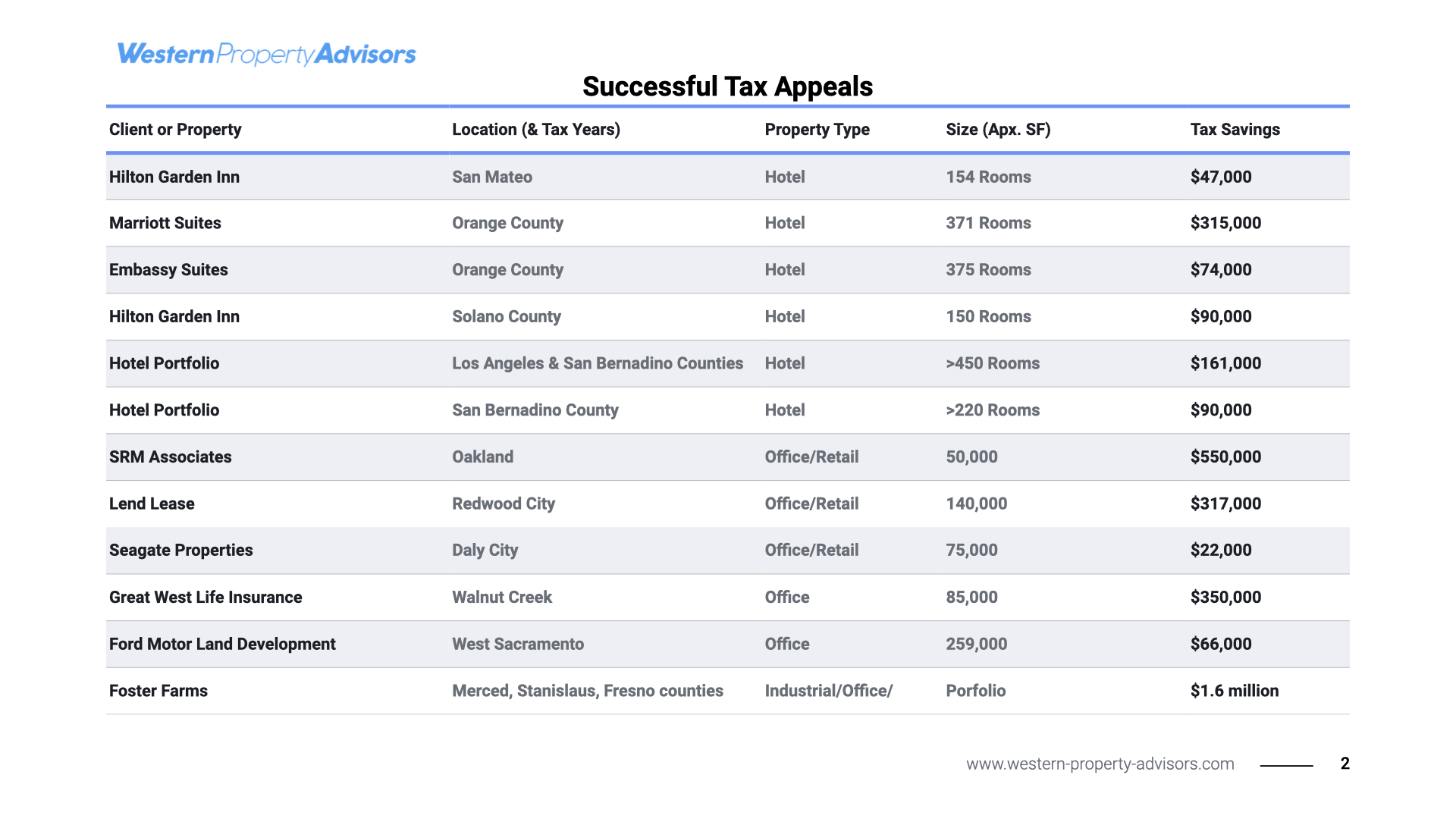

Our Tax Appeal Clients Western Property Advisors

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Understanding California S Property Taxes

Apple Fighting High Property Tax Assessments In Santa Clara County Appleinsider

Bay Area Real Estate Recovery Creates Property Tax Appeal Opportunities

Apple Google Genentech Appeal Property Assessments

Property Tax Disputes Moskowitz Llp Tax Law Firm

Welcome To The Assessment Standards Services And Exemptions Division

Property Tax Workshop Geared Toward Commercial Owners Gilroy Dispatch Gilroy San Martin Ca

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara